Comprehensive Financial Solutions

CUSTOMIZED TO MEET THE NEEDS OF YOUR FAMILY IN LIFE AND AFTER

EXPAND YOUR FAMILY

Receive A ONE TIME LUMP SUM to help pay for IVF AND IUI fertility treatment costs. Setup your child’s million dollar baby plan.

RETIRE AT YOUR DISCRETION

Tax-free retirement income through policy loans, withdrawals, or riders, using the policy’s cash value, if sufficiently funded.

GENERATIONAL PLANS

Potentially help cover college costs through policy loans and withdrawals, using the policy’s cash value, if sufficiently funded.

PROVIDE AND PROTECT

Help ensure your family can stay in their home and make ends meet in the event of the death of the sole or joint breadwinner, with permanent life insurance supplemented with term life coverage.

INCOME FOR LIFE

Receive money during your lifetime for a qualifying diagnosis of Alzheimer’s disease or Lewy Body Dementia.

If you couldn’t work for 90 days due to an injury or illness would you still be able to pay your bills for 50 months un-interrupted without using your savings or credit cards?

YOU + LIVING BENEFITS =

LIFE INSURANCE YOU DON'T HAVE TO DIE TO USE

PROVISION WITHOUT THE PAIN

Strategies for Leaving an Inheritance and a Legacy

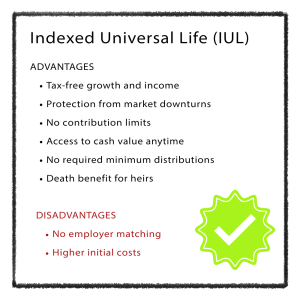

Indexed Universal Life (IUL) insurance provides a unique combination of life insurance protection and wealth accumulation potential. Unlike traditional investments, IUL offers tax-free growth, protection from market downturns, and lifetime financial security.

Key Benefits:

- Tax-free growth and income potential

- Protection from market crashes with guaranteed minimum returns

- Access to your cash value at any time, for any reason

- Death benefit protection for your loved ones

- No contribution limits like 401(k)s or IRA

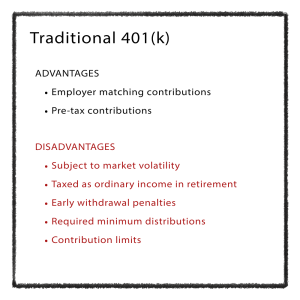

IUL vs. Traditional 401(k)

Term life insurance provides straightforward, affordable coverage for a specific period. It’s an excellent solution for those seeking maximum protection at minimal cost, especially during key life stages like raising children or paying off a mortgage.

Key Benefits:

- Affordable premiums for maximum coverage

- Simple, straightforward protection

- Coverage during your most financially vulnerable years

- Peace of mind for you and your family

- Options to convert to permanent coverage later

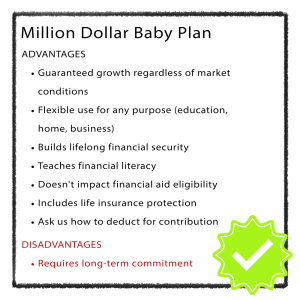

The Million Dollar Kid Plan is a specialized whole life insurance policy designed specifically for children. With minimal monthly contributions, you can secure a financial future worth $1 million or more for your child or grandchild.

Key Benefits:

- Guaranteed growth to $1 million or more

- Lock in low premiums while your child is young

- Create a financial foundation they can’t outlive

- College funding, first home purchase, or retirement supplement

- Teach financial responsibility from an early age

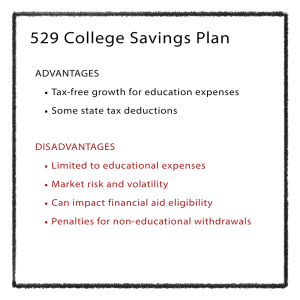

Million Dollar Baby Plan vs. 529 College Savings

Mortgage protection insurance is designed specifically to pay off your mortgage if you pass away, ensuring your family can remain in their home without financial strain. Unlike traditional life insurance, it’s specifically tailored to protect your largest asset.

Key Benefits:

- Peace of mind knowing your family can keep their home

- Decreasing benefit that matches your mortgage balance

- Often more affordable than traditional life insurance

- Simple qualification process

- Protection during your most financially vulnerable years

Many Americans have inactive 401(k) accounts from previous employers that are underperforming or forgotten. Our 401(k) rollover solutions help you consolidate these accounts, potentially reduce fees, and implement more effective growth strategies.

Key Benefits:

- Consolidate multiple retirement accounts for easier management

- Potentially reduce fees and expenses

- Access more investment options

- Implement a cohesive retirement strategy

- Take control of your financial future

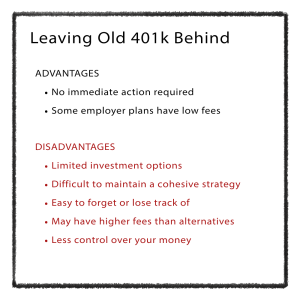

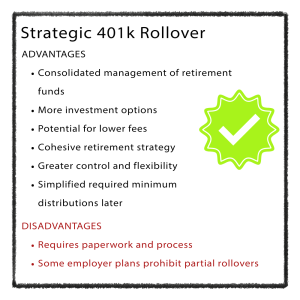

401(k) Rollover vs. Leaving It Behind

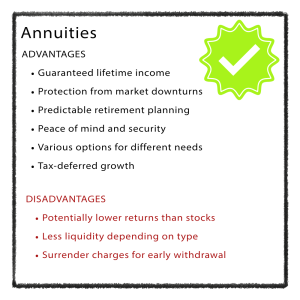

Annuities provide guaranteed income for life, eliminating the fear of outliving your savings. They’re an essential component of a comprehensive retirement strategy, creating predictable income regardless of market conditions or how long you live.

Key Benefits:

- Guaranteed income for life

- Protection from market volatility

- Tax-deferred growth potential

- Various options to match your specific needs

- Peace of mind in retirement

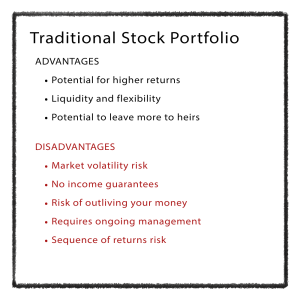

Annuities vs. Traditional Stock Portfolio

Life insurance is the foundation of financial security, providing protection for your loved ones and potentially building cash value over time. We offer a range of life insurance solutions tailored to your specific needs and goals.

Key Benefits:

- Financial protection for your loved ones

- Tax-free death benefit

- Options for cash value accumulation

- Estate planning and wealth transfer

- Business continuation planning

Every business had that special someone who knows things that are critical to the sustainability of the business. If something happens to them – everyone will feel it.

- Safeguard your business and the individuals steering its success.

- Cover key employees crucial to business continuity in a cost-effective manner.

- Coverage can be especially important if employee travels frequently.

Why Clients Choose to Work With Us

Thousands have positioned their families for legacy that brings generational value to their last name.